Patented AI Automation Software for

K-1s | 1099s | W-2s | 990s

Built for accounting firms, funds, family offices, fund admins & tax-exempt orgs processing Schedule K-1s and 990s in volume

PRIVATE MARKET TAX DATA. DIGITIZED. DISTRIBUTED. DECODED.

End-to-end tax data operations for private markets — beyond extraction

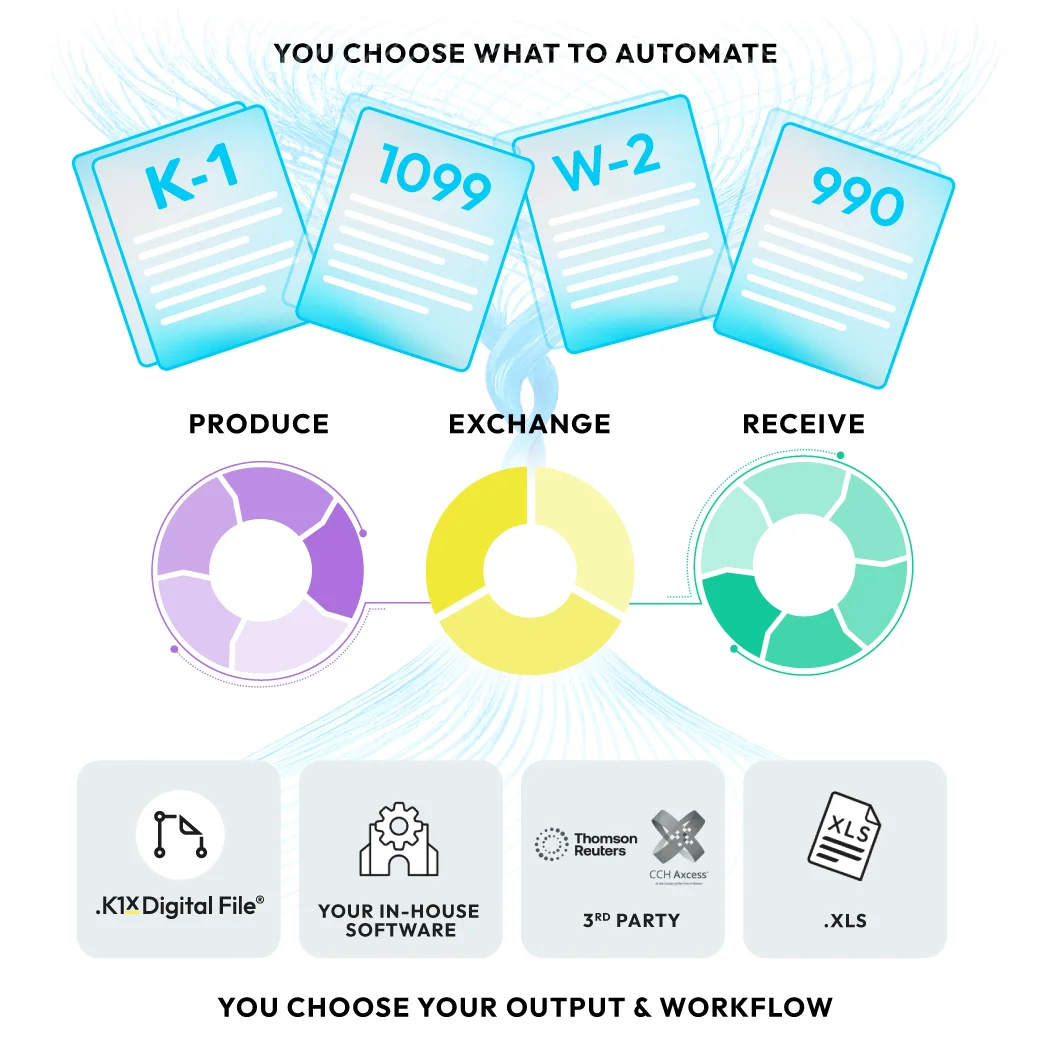

Your tax stack. Your tax data. Your way.

The vendor-neutral tax data operations solution for private markets:

Go beyond the face page from intake to insights. Turn tax forms into structured, digital data: decoded, validated, produced, and ready to move.

Keep your tax suite.

Fix your private market data problem.

eXtract K1, 1099, W-2 data. Cut 90% manual work.

eXecute digital K-1 production — standardized and distribution-ready

eXpand top-line growth with your newly free time

eXpedite IRS-approved 990 e-filing

eXchange K-1’s at scale with

eXceptional APIs & custom XLS reports

50% Saved

Time-savings from K-1 automation using K1x

![]()

“K1x Has Transformed Our Exempt Org. Tax Practice For The Better”

K1X solved the problem of having all company historical tax data and various forms in one place. With a click of a button, they eliminate the need of duplicating data input!

Susanne S.

Accountant

![]()

“Making white paper detail a breeze”

It is extremely user friendly and very fast This product is eliminating a review step and a data entry step. It also speeds up the entry process

Shauna I.

Tax data integration/ Production Accounting

![]()

“K1x Has Transformed Our Exempt Org Tax Practice For The Better”

The software is much more user friendly than its competitors with easy navigation, the option save all changes made automatically and the ease of importing and exporting data.

Verified User in Accounting

![]()

“Excellent for reading Fed K-1s”

I like how accurately and easily it can read the Fed K-1 and pushes it into CCH. Makes it easier to tie out the return at the end of the day….allowing staff to work quicker.

Verified User in Investment Management Mid-Market

![]()

“K1X Works!”

I highly recommend K1x and 990 Tracker…you will not be disappointed with the software, ease of use, and help… K1x allows [our CPAs] to log in to view the returns so there is no back and forth with PDFs and getting confused…

Daniel F. Senior Tax Accountant

![]()

“Effortless Data Extraction with Impressive Accuracy”

My team appreciates the ease of use, the accuracy… The allows our team to focus on more high level value adding work, resulting in better compliance and increased tax savings.

Verified User in Higher Education

![]()

“First Year Not for Profit Preparation”

Our greatest benefit was the time saving in the review process. Since the platform instantaneously updates the tax returns, there is less back and forth, and NO delay, in the preparation through final approved tax return process.

Timothy W. Tax Director

![]()

“Streamlined Tax Filings, Exceptional Support”

I use K1x to efficiently complete and compile tax returns for multiple states, ensuring all numbers match. It saves all supporting work papers to the cloud for easy review and simplifies my job…

Reina M.

Awards for Tax Data Excellence

using K1 Aggregator

for sustained success and continued growth

eliminated

I think everybody should use this!

using K1 Aggregator

for sustained success and continued growth

eliminated

I think everybody should use this!

using K1 Aggregator

for sustained success and continued growth

eliminated

I think everybody should use this!

using K1 Aggregator

for sustained success and continued growth

eliminated

I think everybody should use this!

using K1 Aggregator

for sustained success and continued growth

eliminated

I think everybody should use this!

~100%

ACCURACY

Proven results.

The only patented, AI-powered platform that streamlines alternative investment & private market tax data distribution for investors and advisors. Battle-tested by the best. Trusted by more than 40,000 organizations.

66%

CYCLE

TIME

REDUCTION

Accounting Alliances & Associations

K1x is a member of premier accounting associations -extending our powerful capabilities to larger networks for knowledge sharing, education, and advocacy.