Patented AI Automation Software for

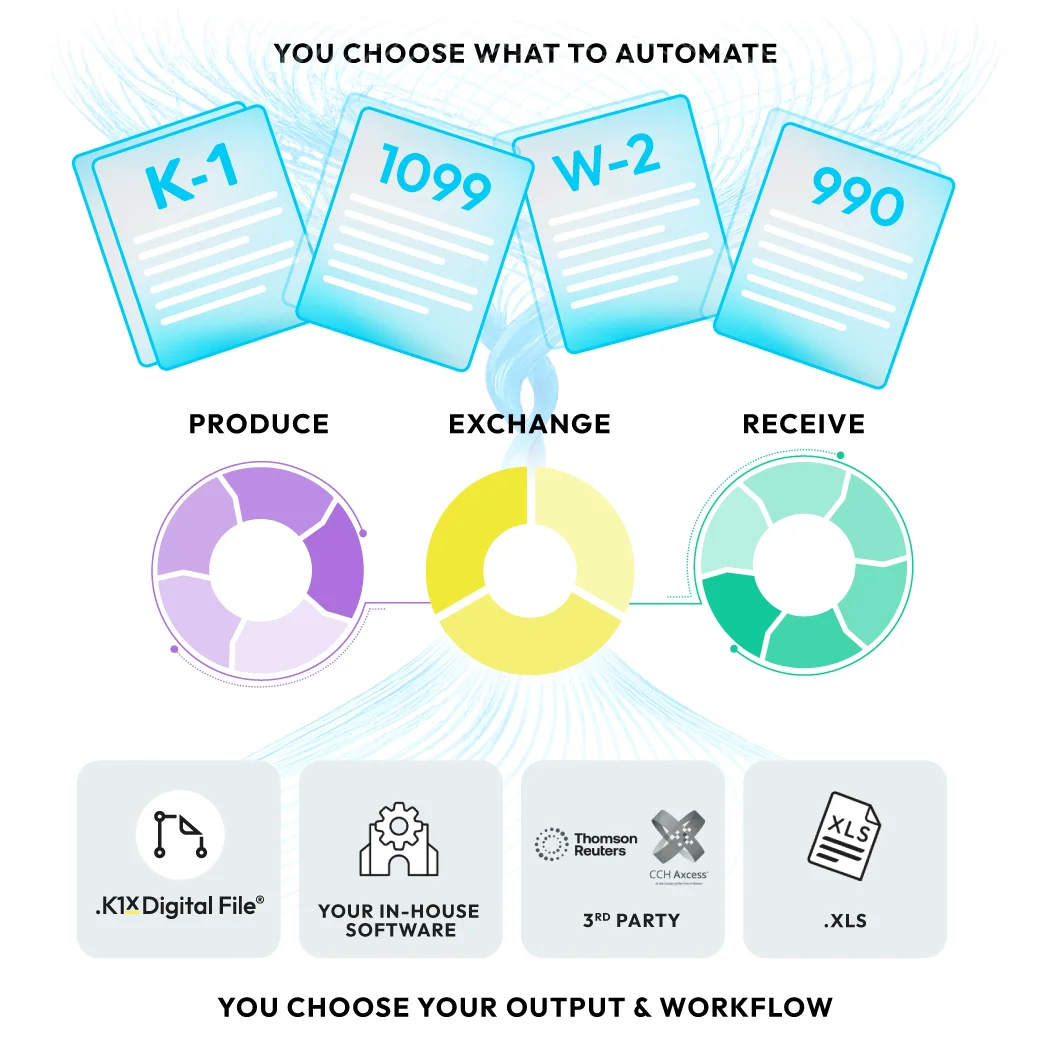

K-1s | 1099s | W-2s | 990s

Built for accounting firms, funds, family offices, fund admins & tax-exempt orgs processing Schedule K-1s and 990s in volume

PRIVATE MARKET TAX DATA. DIGITIZED. DISTRIBUTED. DECODED.

End-to-end tax data operations for private markets — beyond extraction

Your tax stack. Your tax data. Your way.

The vendor-neutral tax data operations solution for private markets.

No vendor lock-in. No forced migrations.

Go beyond the face page from intake to insights. Turn tax forms into structured, digital data: decoded, validated, produced, and ready to move.

Keep your tax suite.

Fix your private market data problem.

eXtract K1, 1099, W-2 data. Cut 90% manual work.

eXecute digital K-1 production — standardized and distribution-ready

eXpand top-line growth with your newly free time

eXpedite IRS-approved 990 e-filing

eXchange K-1’s at scale with

eXceptional APIs & custom XLS reports

50% Saved

Time-savings from K-1 automation using K1x

![]()

“Excellent for reading Fed K-1s”

I like how accurately and easily it can read the Fed K-1 and pushes it into CCH. Makes it easier to tie out the return at the end of the day….allowing staff to work quicker.

Verified User in Investment Management Mid-Market

![]()

“Making white paper detail a breeze”

It is extremely user friendly and very fast This product is eliminating a review step and a data entry step. It also speeds up the entry process

Shauna I.

Tax data integration/ Production Accounting

![]()

“K1x Has Transformed Our Exempt Org Tax Practice For The Better”

The software is much more user friendly than its competitors with easy navigation, the option save all changes made automatically and the ease of importing and exporting data.

Verified User in Accounting

![]()

“K1X Works!”

I highly recommend K1x and 990 Tracker…you will not be disappointed with the software, ease of use, and help… K1x allows [our CPAs] to log in to view the returns so there is no back and forth with PDFs and getting confused…

Daniel F. Senior Tax Accountant

![]()

“Effortless Data Extraction with Impressive Accuracy”

My team appreciates the ease of use, the accuracy… The allows our team to focus on more high level value adding work, resulting in better compliance and increased tax savings.

Verified User in Higher Education

![]()

“First Year Not for Profit Preparation”

Our greatest benefit was the time saving in the review process. Since the platform instantaneously updates the tax returns, there is less back and forth, and NO delay, in the preparation through final approved tax return process.

Timothy W. Tax Director

![]()

“Streamlined Tax Filings, Exceptional Support”

I use K1x to efficiently complete and compile tax returns for multiple states, ensuring all numbers match. It saves all supporting work papers to the cloud for easy review and simplifies my job…

Reina M.

Awards for Tax Data Excellence

using K1 Aggregator

for sustained success and continued growth

eliminated

I think everybody should use this!

using K1 Aggregator

for sustained success and continued growth

eliminated

I think everybody should use this!

using K1 Aggregator

for sustained success and continued growth

eliminated

I think everybody should use this!

using K1 Aggregator

for sustained success and continued growth

eliminated

I think everybody should use this!

using K1 Aggregator

for sustained success and continued growth

eliminated

I think everybody should use this!

~100%

ACCURACY

Proven results.

The only patented, AI-powered platform that streamlines alternative investment & private market tax data distribution for investors and advisors. Battle-tested by the best. Trusted by more than 40,000 organizations.

66%

CYCLE

TIME

REDUCTION

Accounting Alliances & Associations

K1x is a member of premier accounting associations -extending our powerful capabilities to larger networks for knowledge sharing, education, and advocacy.

TAKE THE K1 TEST DRIVE

Don’t just see it. Do it!

Drag. Drop. Digitize.

Distribute. Decode.

Proven results.

K1x is battle-tested by the best, and trusted by more than 40,000 organizations, with clients including:

80

K-1s EXTRACTED

IN JUST 8 MINUTES

47

STATE & FEDERAL

TAX JURISDICTIONS

410

TAX FORMS FOR

42 FEDERAL & STATE

TAX JURISDICTIONS

44

OF THE TOP 100

INSTITUTIONAL INVESTORS

20

OF THE TOP 25

ACCOUNTING FIRMS

51

OF THE TOP 100

NON PROFITS

45

OF THE TOP 100

UNIVERSITY ENDOWMENTS

8

OF THE TOP 40

HEALTH SYSTEMS

11

OF THE TOP 100

PRIVATE FOUNDATIONS

K1x FAQ

What is K1x and how does it transform tax operations?

K1x is the leading AI-powered tax technology platform designed to digitize, standardize, and automate complex private market tax data. By using patented machine learning to extract data from K-1s, 1099s, and 990s, K1x creates a connected data layer that eliminates manual entry and accelerates the filing process for over 40,000 organizations.

How much time and cost can an organization save with K1x?

Independent analysis shows that K1x typically delivers a 311% ROI with a break-even period of just 4 months. Accounting firms and institutional investors report a 55–65% reduction in K-1 processing times and a 90% reduction in manual data entry, allowing teams to reclaim thousands of professional hours each year.

Is K1x compatible with leading tax preparation software?

Yes, K1x is built for seamless interoperability with the industry’s most critical tax systems, including CCH Axcess™, ONESOURCE™, and GoSystem® Tax RS. Our integration toolkit ensures that validated tax data flows directly into your existing workpapers and software without the risk of manual transcription errors.

What makes K1x’s AI technology unique in the tax industry?

K1x holds a unique patent for machine learning systems specifically designed to summarize and extract data from non-structured tax documents. Unlike generic OCR, our AI is trained on hundreds of thousands of complex tax forms, allowing it to handle intricate K-1 allocations and K-3 international data with industry-leading accuracy.

How does K1x ensure data security for institutional investors?

K1x maintains the highest levels of data protection through SOC 2 Type II compliance and enterprise-grade encryption. Trusted by 44 of the top 100 institutional investors and 20 of the top 25 accounting firms, our platform follows rigorous AICPA standards for security, confidentiality, and processing integrity.

How long does it take to implement K1x across a firm?

K1x is a web-based SaaS platform designed for rapid deployment. Most organizations can begin processing data within 1–2 weeks, with our dedicated client success team providing structured onboarding, training, and technical integration support to ensure a smooth transition before peak tax season.