Product Updates

K1x Product Update 2025-10-27

BY Scott Turner

October 29

Next Up: Fresh Innovations to Make Tax Time Less Taxing

In addition to its leadership in automating K-1s, 1099s, W-2s, and 990s, K1x is launching multiple new initiatives and features that speed tax compliance workflow through digitization, distribute data with precision, and decode for superior insights. Learn about what’s next up for K1 Aggregator, K1 Creator, and 990 Tracker…

NEXT UP

Further streamline your tax workflow with a new AI-powered W-2 extraction feature that automatically extracts and maps data from your W-2s. The Aggregator Plus™ upgrade option takes you beyond the face page and beyond simple scanning of structured data in one powerful, patented platform.

- Tax Year 2025 Updates: No reconfiguration required. K1 Aggregator® customers stay fully aligned with the latest IRS and foreign form changes. The initial release delivers full extraction and review support for the newest K-1 and K-3, with foreign form updates and integrations to TAX FILING SYSTEM following later in Q1. Firms can trust K1x to be ready before filing season.

- Parsing K-1s: Smart K-1 document separation for fed, state, international.

Users can drag and drop a consolidated packet, even if it includes multiple partners or states, and the system intelligently detects, splits, and classifies each K1 into the right structure for review and extraction. - Improved State and International Extraction: With refined AI models for all 42 US jurisdictions and expanded recognition of complex international attachments, you get even cleaner data with fewer exceptions.

- CCH Partial Integration: Control which parts of a K-1 get pushed into your tax prep software. This new feature, you can integrate Federal, State, or K-3 data selectively (down to the specific jurisdiction or country) keeping tax returns clean, accurate, and in sync with your workflow.

- Workspace Administration: For modern tax team management, a centralized control hub that lets you securely organize portfolios, users, and permissions across onshore and offshore teams.

- Custom Reporting: Building on our four core reports (K-1 Line Item, Foreign Transfers, 199A, and K-3 Line Items), users can create and save personalized reports, choosing the exact data points they want, arranging columns, and exporting to Excel instantly. It’s the fastest path from extracted data to tailored insights, designed for how you work.

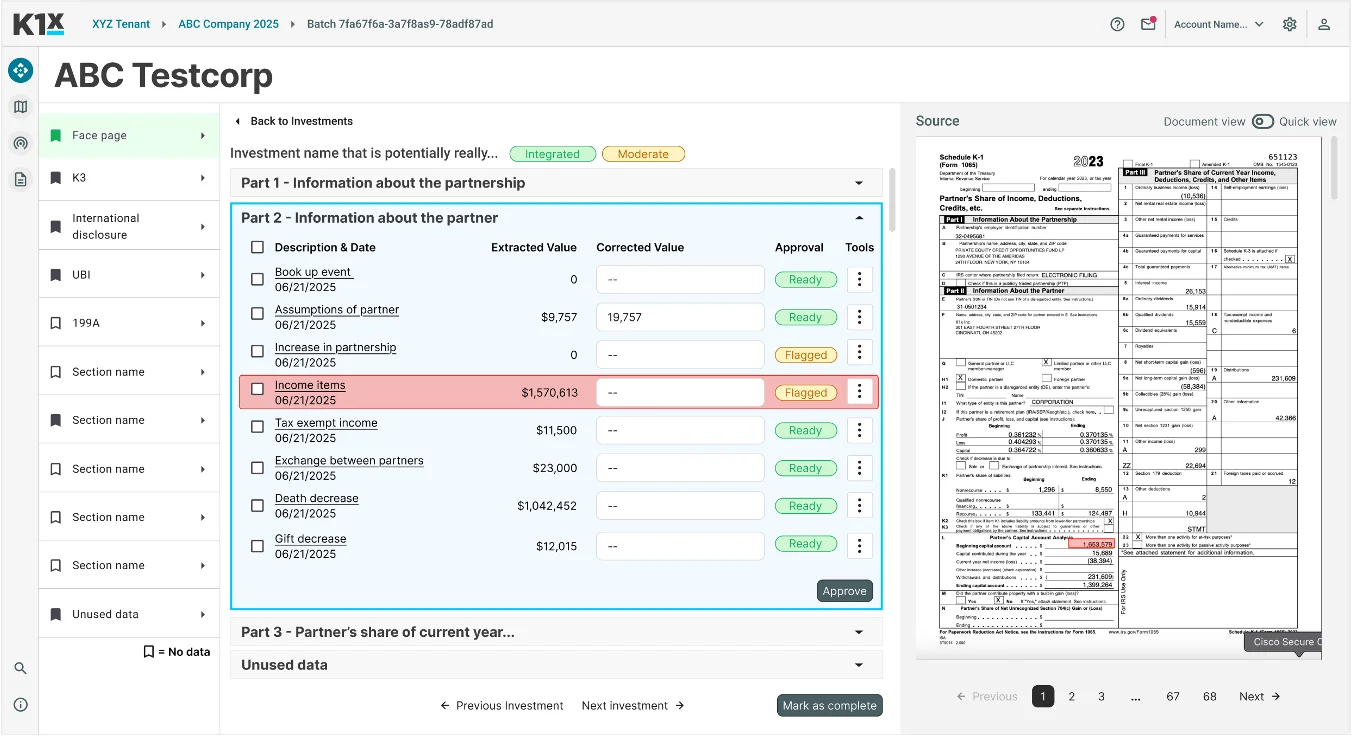

- Facilitated Workflow: No “black box”, traceable results, instant verification.We are making AI-powered extraction transparent, verifiable, and interactive. Users no longer need to wonder “where did this number come from?” or dig through PDFs.

Got a question regarding K1 Aggregator®? Start here.

NEXT UP

Modernizing the K-1 Generation Experience

- Tax Year 2025 Updates: No reconfiguration required. K1 Creator® customers stay fully aligned with the latest IRS changes. The initial release on January 15, 2026 provides initial access, helping you get your engagements set up, with subsequent releases later in Q1 delivering K-1, K-3, and integrations to CCH.

- Standardized footnote library: pre-built templates from a centralized repository give clients a head start, accelerating onboarding and reducing setup time. Massive time-savings and one of our most requested new features.

- Composite/Withholding Forms Support: Automate the generation of state composite and withholding forms directly within each investor’s K-1 package-eliminating the manual, state-by-state process tax preparers traditionally face. The platform applies jurisdiction-specific logic to calculate composite inclusion and partner-level withholding obligations, pulling directly from your apportionment and allocation data.

Got a question regarding K1 Creator®? Start here.

NEXT UP

Modernizing the K-1 Generation Experience

- Tax Year 2025 Updates: No reconfiguration required. Ensures 990 Tracker® remains fully aligned with the latest IRS updates across the Form 990 series and related schedules. The initial release on January 15, 2026 provides initial access, allowing you to get your engagements set up, with subsequent releases delivering complete support for the newest IRS form schemas, validation rules, and e-file specifications, including updated diagnostics, review logic, and filing readiness checks for all 990-series forms.

- E-File Validation & Diagnostics Guidance: An AI-powered feature that transforms raw IRS rejection codes and validation errors into plain-language, actionable insights. Leveraging specialized Tax-Exempt LLMs trained on IRS schemas, validation rules, and historical rejection data, this feature empowers filers to understand why their return was rejected and exactly how to fix it.