Product Updates

K1x Product Update 2025-03-18

BY Scott Turner

March 18

Introducing the Latest K1x Product Enhancements: More Automation, More Accuracy, More Efficiency

At K1x, we’re constantly innovating to help tax professionals streamline workflows, increase accuracy, and reduce manual effort. Our latest product updates bring powerful enhancements across K1 Aggregator®, 990 Tracker®, and K1 Creator®—helping you work smarter, not harder.

- K1 Aggregator® users will benefit from enhanced data extraction, improved Partial Packet Processing, and new workflow optimizations that make K-1 handling even easier.

- 990 Tracker® now offers extended support for Form 8995-A and Form 3800, helping tax-exempt organizations and their advisors simplify compliance for these complex filings.

- K1 Creator® has been upgraded with Centralized Data Management, a Streamlined & Scalable Data Set, and Highly Customizable K-1 Packages, giving you more control and flexibility in investor reporting.

Read on for a detailed breakdown of these updates and how they enhance your tax workflows.

BRAG WORTHY UPDATES

K1 processing isn’t just about extracting data faster—it’s about extracting more data with less effort. That’s why we’re thrilled to announce our April 2025 Release, bringing enhanced extraction capabilities for complex footnotes, streamlined workflow improvements, and intelligent processing features right where your team already works.

Enhanced Extraction: Footnotes that matter

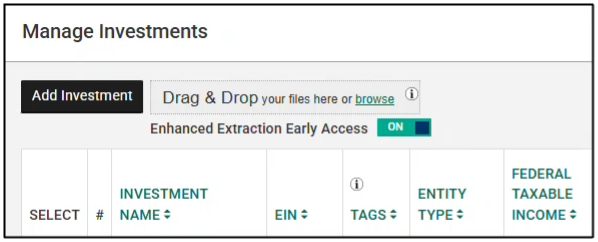

Our new Enhanced Extraction Model is here, bringing intelligent footnote extraction to handle the most complex aspects of K-1 processing. Extract UBI data for tax-exempt organizations, capture Section 199A information for QBI deductions, identify Form 926 foreign transfers, and process K-3 Overflow statements—all with one-click opt in, putting you in control of when you’re to adopt this powerful technology. This AI-powered enhancement turns footnote processing into a strategic advantage, dramatically reducing manual data entry while maintaining human verification for critical tax decisions. Plus, our improved document processing handles a wider range of formats (scanned, encoded, rotated, poorly formatted) for better extraction across all document types. Try our new Extraction Model by toggling it on in the application on April 1!

Partial Packet Processing: Start sooner, finish faster

In response to high demand from our users, we’re introducing Partial Packet Processing, a new workflow that lets you upload K-1 forms as they arrive rather than waiting for complete packages. This feature eliminates the need to delay processing until all documents are received, allowing you to begin work with the forms you have on hand.

Start analyzing available data immediately, make informed decisions earlier, and eliminate the waiting period that traditionally bottlenecks your tax season—all with one upload right from your dashboard.

Multiple improvements, one clear workflow

Now you can work more efficiently with our new workflow improvements. Our Automatic Reclassification feature gives you one-click reclassification, as well as suggests appropriate classifications based on intelligent description analysis. Combined with enhanced support for Passive/Active Activities identification, you’ll transform raw K-1 data into structured, categorized information that provides deeper insights and more meaningful analytics for better decision-making.

Expanded Form Support

Great news for 990 Tracker users! In addition to supporting 45 (+14%) new forms and 20 (+21%) E-Files for 2024, we’ve also expanded our form support to include Form 8995-A for Tax Years 2023 and 2024, making it easier to calculate and report qualified business income deductions for pass-through entities. Additionally, we are supporting the new IRS-revamped Form 3800 for Tax Year 2024, streamlining general business credit calculations.

These additions provide a more comprehensive tax preparation solution, especially for organizations receiving partnership income that requires QBI deduction reporting. Combined with the enhanced UBI and 199A extraction in K1 Aggregator, you now have an end-to-end solution for managing these complex tax elements across both products.

Modernizing the K-1 Generation Experience

We continue to make great investments in our K-1 creation tool – the only solution that can create a Digital K-1. Following our January update that introduced our enhanced statement creation tool, we’re working tirelessly to revolutionize how Schedule K-1s are prepared and distributed.

New features to come in our upcoming release are:

- Centralized Data Management: A unified data structure that stores all information in the minimum number of locations, drastically simplifying your data management process.

- Streamlined and Scalable Data Set: Optimized calculated data sets that support large investor volumes and multiple jurisdictions, making the tool exceptionally scalable for partnerships of any size.

- Highly Customizable K-1 Packages: Advanced customization options for footnotes, structure, and other aspects of K-1 packages, giving preparers unprecedented flexibility to meet specific reporting needs. For accounting firms, you’ll benefit from having a firm standard for K-1 packets across the entire firm.

These enhancements will make K-1 generation substantially faster and easier to manage, particularly for large-scale partnerships. Preparers will be able to produce customized K-1 packages more efficiently, saving valuable time during tax season while handling complex investor and jurisdictional requirements with ease.

Want to know more about K1 Creator®? Reach out to your Customer Success Manager or contact inquiries@k1x.io today to learn more about this revolutionary K-1 creation tool.

About K1x, Inc.

A Fast Company “Most Innovative Companies 2025” honoree, K1x is the leading data distribution platform for alternative investment tax compliance as well as the industry standard, IRS-certified solution for seamless tax-exempt filings. The fintech company’s patented, AI-powered SaaS solution digitizes and distributes tax data seamlessly–connecting investors, accounting firms, tax software, IRS and state taxing authorities–simplifying complex processes, accelerating filings, reducing costs, and delivering greater control and accessibility. K1x is battle-tested by the best, and trusted by more than 8000 organizations including 44 of 100 largest institutional investors in the US, 20 of the top 25 accounting firms, 11 of the top 100 private foundations, 45 of the top 100 university endowments, and 7 of the top 40 health systems.

Visit us at K1x.io and follow us on LinkedIn.