Patented Corporate Tax Software

Tax Data Operations Platform for Private Markets

Built for accounting firms, investors, family offices, fund administrators, and tax-exempt organizations to automate K-1, 1099, W-2, and 990 workflows—beyond extraction alone.

Our patented tax technology created the world’s first Digital K-1® experience

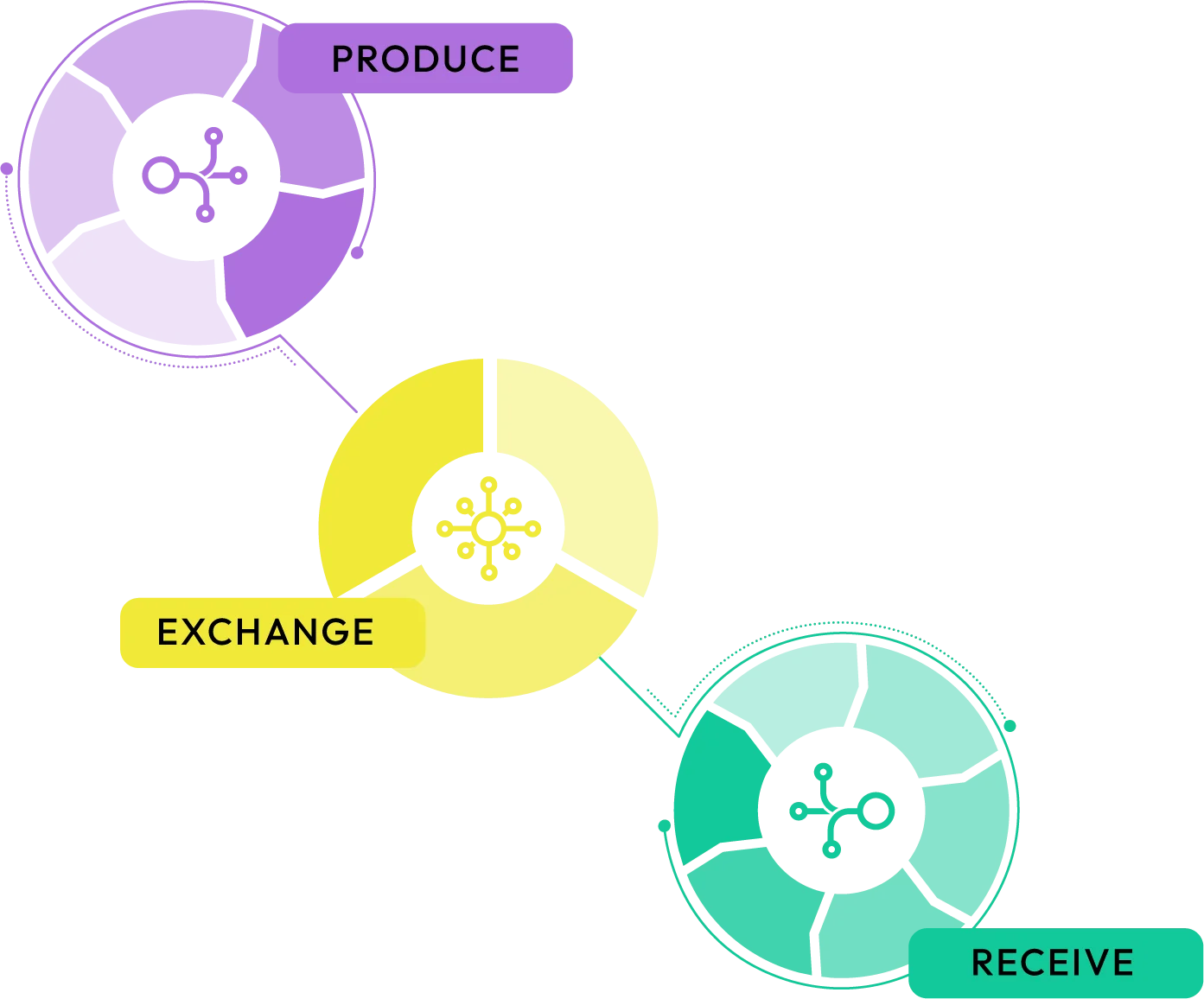

One secure, integrated workspace to receive, produce, and exchange private market tax data

PRODUCE

Designed for producing K-1s at scale under review and delivery pressure.

- Wizard-driven guidance for tax filings

- Standard workflow & schema

- Universal footnote library

RECEIVE

Ideal for teams overwhelmed by inbound tax doc volume & complexity.

- AI-powered data extraction

- Auto validation of taxable income

- Embedded tax guidance analytics

EXCHANGE

Built for organizations distributing tax data to many stakeholders securely and at scale.

- Secure environment

- Instant digital transfer

- Auto matching of Investors to funds

BEYOND EXTRACTION

Extraction is only step one. K1x runs tax data operations end-to-end. K-1 receipt, production, exchange, and 990 workflows. With validation, governance, and integrations built in. Without the vendor lock-in.

| EVALUATION CRITERIA | THE OTHERS (Extraction-Only Tools) | K1x PLATFORM (End-to-End Tax Data Ops) |

| What you get | Extraction Tool | A secure, integrated workspace to receive, produce, and exchange private market tax data complete automation of K-1s, 1099s, W-2s, 990s |

| Outputs | XLS | Your choice: Digital .K1x file, APIs to your workpapers or other tech in your stack, integrations to 3rd party tax software like CCH & TR, XLS, or check out the partners in our K1xCollective |

| Depth of K-1/K-3 coverage | Often face page focused; limited Whitepapers/footnotes/state | Comprehensive extraction across federal + state, K-3, whitepapers, and footnotes (platform-grade for complex packages). |

| Validation & tax context | Limited validation; “data out” but user still must verify. | Context-aware compliance with validation logic aligned to tax rules—built to reduce downstream review burden. |

| Standardization | Outputs vary by source; manual mapping and cleanup required. | Standardized schema + structured data that stays consistent across entities, years, and recipients. |

| Workflow governance & auditability | Next steps happen in email/spreadsheets; limited audit trail. | Centralized workflow controls, versioning, and traceability designed for compliance and repeatability (operations, not one-off extraction). |

| Exchange & distribution | Export/import between parties; rekeying and reconciliation are | Built-in digital exchange so the right data reaches the right party fast—supports a structured digital file workflow (not just an export). |

| K-1 package production | Not designed for issuer workflows; typically outside scope. | Supports K-1 production workflows (digital packages, footnotes, allocations, statements) alongside downstream distribution. |

| 990 workflows | Usually separate tools/processes. | Streamlines IRS-certified 990 e-filings and related exempt workflows as part of the platform. Fully integrated to flow your K1s into your 990T filings & directly e-filable with IRS & state jurisdictions |

| Integrations & API | Siloed outputs; limited connectivity. | Flexible integrations + API to keep your tax data moving across systems— connected or decoupled as needed. |

| Security & compliance posture | Varies widely; sometimes unclear. | Security-forward posture (matrix emphasizes SOC 2 and 7216 compliance). |

| Best fit | Small-volume, one-off conversion needs. | High-volume, high-stakes private market workflows where speed + correctness + governance + exchange matter. |

Note: Capabilities vary by vendor. This table reflects common extraction-only limitations versus K1x’s platform approach.

BENEFITS

100%

control and

transparency

66%

cycle time

reduction

improved staff engagement, retention and elevation

90%

manual data extraction

elimination

hours of time restored

each week

weeks slashed each

cycle

+26%

savings in end to end

processing costs

You choose what to automate

Start with one workflow. Expand as your needs grow. Without rebuilding your tax stack.

Automate Receipt

of K-1s, 1099s, and W-2s

Automatically aggregate federal K-1 and K-3 data plus state and foreign disclosures for portfolio-level review and reporting. Optional automation for 1099’s & W-2’s.

Filterable/customizable data reports and exports for deep risk analysis, review, and Excel output options

Embedded project management and review features to keep the process running smoothly

Automate K-1

production

First-ever fully digital investor K-1 packages, including footnotes, allocations, and white paper statement data

Support for K, K-1, K-2, and K-3 and 42 state taxing jurisdiction

Instant Digital PDF creation options — compatible with existing portal providers

Automate 990 Exempt Reporting and Filing

IRS approved e-filing for 990, 990-PF, 990-EZ, 990-T, 4720,

and 8868 + support for all 42 state taxing jurisdictions

Master Compensation module for reporting across multiple entities

Conflict of Interest modules to manage board questionnaires

Integrate K1x into the tools you already use, and keep your data moving across teams, systems, and stakeholders.

“K-2s and K-3s also used to be a nightmare for us. Now we have drag and drop and integration with important third-party software. We use K1x to help us do our 20 state returns –and to file on time without the hassles and wasted time.”

Take the K-1 Test Drive!

Drag and drop example K-1s into award-winning K1 Aggregator® software. Experience the power of K1x automation and see results.

See extracted + validated results, review flags, and export-ready outputs.