Product Updates

K1x Product Update 2026-01-23

BY Scott Turner

January 23

Tax Year 2025 now live across all products, delivering faster rollovers, smarter workflows, deeper integrations, and greater transparency—so teams can spend less time wrangling documents and more time delivering high-value outcomes.

Recent Updates

Tax Year 2025 is now available!

- K1 Aggregator® customers stay fully aligned with the latest IRS and foreign form changes. This initial release delivers full extraction and review support for the latest K-1 and K-3 forms. Foreign form updates and tax filing system integrations will follow later in Q1 – ensuring firms can rely on K1x well ahead of filing season.

- NEW Dynamic Views & Reporting: Create and customize dynamic views to find the data you need – faster and in the format you prefer – using the Enhanced Grid View toggle in Manage Investments. The same dynamic view functionality is available in Review Investments for your K-3 Summary, 199A Data Overview, State Data Overview, and Transfer Summary. Users can create and save personalized views by selecting specific data points, rearranging columns, and exporting directly to Excel. It’s the fastest path from extracted data to tailored insights – designed to match how you actually work.Pro Tip: Right-click and select Export to send the entire table to Excel, streamlining workpaper preparation and data aggregation.

- NEW Digital K-1 File Download

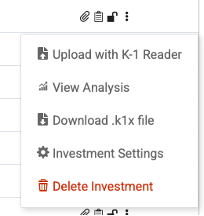

This new capability introduces a portable .k1x file, so you can download K-1s directly from Manage Investments (three-dot menu → Download Digital K-1 File). Designed as the next step toward fully digital K-1 transmission, the .k1x format enables secure storage, seamless sharing, and future-ready reuse – without relying on static PDFs or manual folder management.

Recent Updates

Tax Year 2025 is now available!

- K1 Creator® customers stay fully aligned with the latest IRS updates. The initial release on January 15, 2026 provides early access to get engagements set up, with subsequent releases later in Q1 delivering full K-1 and K-3 support, along with CCH integrations.

- K1Creator’s latest updates are built for speed and scale.Project Rollover (TY2024 → TY2025) delivers significant time savings by carrying forward your full project structure – entities, investors, settings, and mappings – so you can start the new season in minutes, not days. The Federal Forms UI makes preparation and review cleaner and more intuitive with fewer clicks. Investor Setup streamlines onboarding by capturing investor data correctly upfront, reducing downstream fixes across allocations and forms. Footnotes improves disclosure creation through greater standardization, keeping high-volume K-1 packages consistent across investors and entities.These enhancements are especially valuable for accounting firms, fund administrators, and in-house tax teams managing repeat structures and complex economics.

Next up

- Standardized Footnote Library: Pre-built footnote templates from a centralized library give clients a head start – accelerating onboarding, reducing setup time, and delivering significant time savings. One of our most requested new features.

- Composite & Withholding Forms Support: Automate the creation of state composite and withholding forms directly within each investor’s K-1 package, eliminating the manual, state-by-state process tax preparers traditionally face. The platform applies jurisdiction-specific logic to determine composite inclusion and partner-level withholding obligations, pulling directly from your apportionment and allocation data for accurate, consistent results.

Want to know what K1 Creator is? Check out this short video.

Got a question regarding K1 Creator®? Start here.

Recent Updates

Tax Year 2025 is now available!

- Tax Year 2025 Updates: 990 Tracker® remains fully aligned with the latest IRS updates across the Form 990 series and related schedules, ensuring nonprofits and advisors are ready for the upcoming filing season. The initial release on January 15, 2026 provides early access so teams can get engagements set up and begin preparing within the updated framework. Subsequent releases will roll out later in Q1, delivering complete support for the newest IRS form schemas, validation rules, and e-file specifications. These updates include enhanced diagnostics, updated review logic, and filing readiness checks across all 990-series forms – giving users confidence that returns are accurate, compliant, and ready to file.

- Engagement Rollover (TY2024 → TY2025) delivers instant continuity by carrying forward organization details, prior-year data, and engagement setup – eliminating re-keying and saving significant time for firms and in-house teams with 990 returns. The enhanced Federal Forms UI and PDF generation (Forms 990, 990-PF, 990-EZ, 990-T, and 4720) guide you from data entry to ready-to-file output in a single, intuitive flow – speeding preparation and simplifying review. Expanded State Forms UI and PDF generation (AL, AR, CT, GA, ID, ND, UT, and WV) increase coverage without adding complexity, using the same structured data to produce state-ready PDFs for multi-state nonprofits and accounting firms. New Benchmarking (990 export) transforms filings into insights by exporting standardized 990 data for peer comparisons, outlier analysis, and board-ready reporting. Conflict of Interest centralizes disclosures to keep governance compliance simple, consistent, and audit-ready, while Master Compensation establishes a single source of truth for compensation data – reducing inconsistencies and accelerating review. Finally, data integration from K1 Aggregator eliminates duplicate entry by pulling relevant K-1 data directly into 990 Tracker®, delivering major time savings for organizations with complex investments or multi-entity structures.

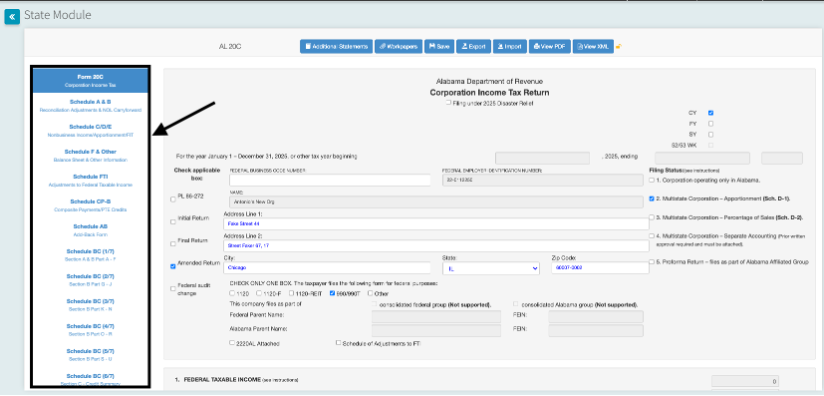

- A Faster Way to Work in State FormsFor Tax Year 2025, we’ve reimagined the state data entry experience in 990 Tracker®. The new State Module Data Entry interface is faster, more responsive, and easier to navigate – designed to reduce friction across multi-page state returns. With significantly improved save and load performance and smoother navigation, teams spend less time waiting and more time moving work forward. It’s a foundational upgrade built for productivity inside the State Module.Available now in the Tax Year 2025 system!

Want to know what 990 Tracker is? Check out this short video.

Got a question regarding 990 Tracker®? Start here.