Blog

K-1 Bottleneck Is Over: How Fund Administrators Can Finally Go Fully Digital

BY Scott Turner

November 11

The K-1 Bottleneck Is Over: How Fund Administrators Can Finally Go Fully Digital

Manual K-1 season costs you time, margins, and investor goodwill. A Digital K-1 ecosystem supplements PDFs and portals with live, structured data that moves instantly between issuers, admins, accountants, and investors.

The annual crunch that shouldn’t be a crunch

Every spring, fund administrators perform heroics: chasing partnership data, normalizing footnotes, reconciling last-mile edits, uploading PDFs, fielding investor emails, and rerunning tie-outs when one upstream figure shifts. It’s a familiar story—labor spikes, error risk climbs, and delivery dates slip.

The root cause isn’t your team—it’s the format. The PDF was created back in 1991 so graphic designers and printers could make sure a page looked exactly the same everywhere. It was perfect for artwork and print layouts—but not for collaborating on financial data that needs to move, update, and be checked for accuracy. A PDF is really just a picture of information. It can’t calculate, validate, or flow.

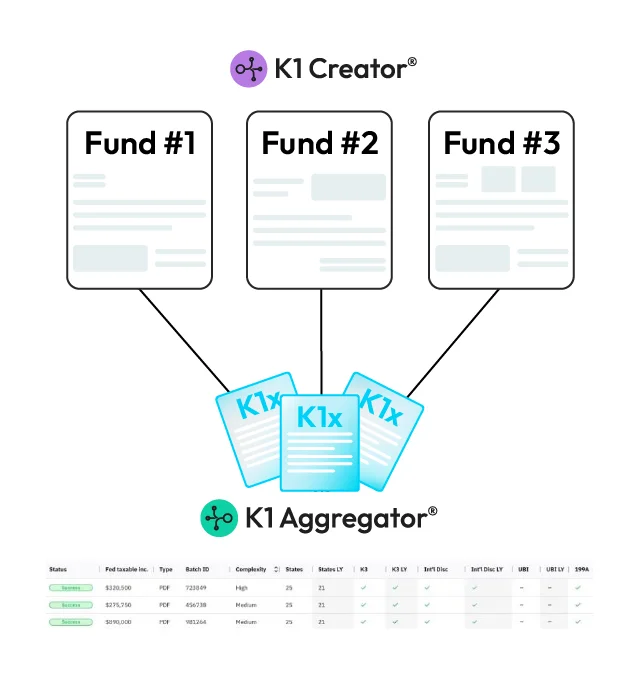

Meet the Digital K-1 ecosystem

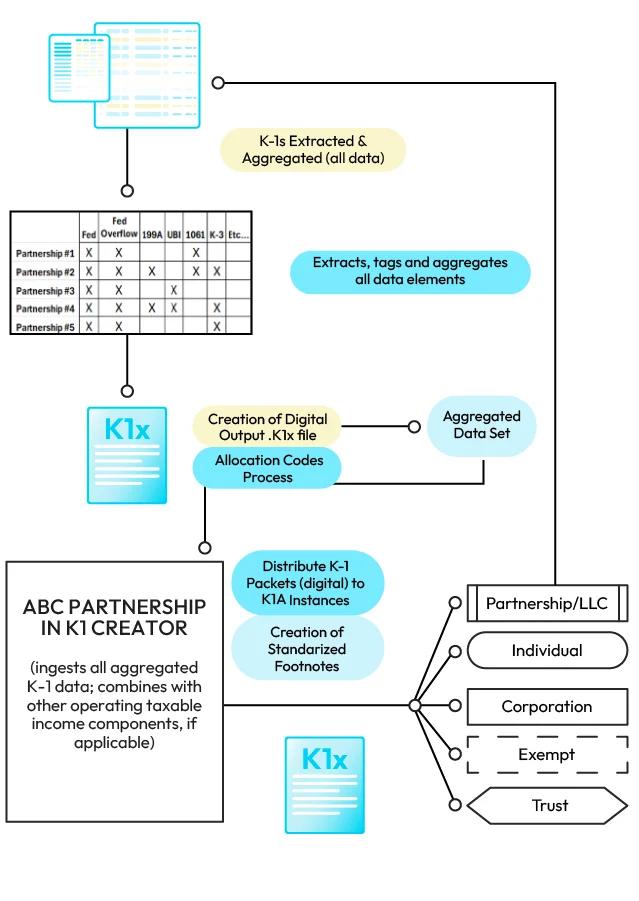

A Digital K-1 ecosystem treats a K-1 not as a static file but as structured, validated, and traceable data—from creation to aggregation to exchange. Instead of emailing and re-uploading PDFs, participants interact with the same underlying canonical K-1 dataset, with permissions and auditability baked in.

What changes for fund admins?

- Less rework, fewer surprises. Data validations and cross-form checks happen up front, not after delivery.

- Single source of truth. Edits propagate to all stakeholders who rely on the same record, eliminating version drift.

- Real-time status. Ops, tax, IR, and external firms can see where every K-1 stands without asking your team for updates.

- Cleaner investor experience. Investors (and downstream accountants) receive usable data. They’re not searching on portal sites for yet another PDF to transcribe.

From “forms and files” to “flows and APIs”

In a digital model, your workflows stop at the point of value—not at a download button.

- Creation → Validation. K-1s are created as data with schema, standard footnotes, and tie-outs embedded—no post-hoc parsing.

- Aggregation → Distribution. Downstream consumers (funds of funds, family offices, tax providers) benefit from a digital transmission rather than scraping through PDFs.

- Exchange → System sync. Create a connected ecosystem between your funds and their underlying investors.

CLICK HERE FOR “A CONNECTED K-1 ECOSYSTEM FOR FUND ADMINISTRATORS”.

NO FORM REQUIRED

What your ops team will feel on day one

- Cycle-time compression. Queueing and handoffs shrink because data is review-ready the moment it’s produced.

- Exception-driven work. Teams spend time on outliers instead of mind-numbing keying, collating, and copy-pasting.

- Happier auditors and LPs. Faster turns and clearer traceability reduce back-and-forth in crunch time.

Risk & compliance benefits (quietly huge)

- Field-level permissions reduce inadvertent exposure of sensitive partner data.

- Deterministic calculations curb spreadsheet-drift and formula fatigue.

- Immutable event logs simplify examiner and auditor requests.

- Granular retention policies keep you aligned with regulatory and client obligations.

What about my current stack?

A digital ecosystem doesn’t demand a rip-and-replace. It wraps your tax prep tools, GLs, CRMs, investor portals, and data lakes:

- In: trial balances, partnership allocations, special items, footnotes, state schedules.

- Out: consumable and investor-ready K-1 data, machine-readable schedules, and, if needed, a human-friendly PDF generated from the canonical record.

A quick vignette

Mid-market PE admin, 400+ entities, March crunch.

Historically: 10–12 week surge; PDF reviews, email ping-pong, and late investor distributions.

Digitally: upstream allocations arrive validated; exceptions route automatically; IR tracks delivery in real time; investors and their accountants consume data directly—no transcription. The team ships earlier, with fewer weekend burns, and fewer “can you resend page 3?” tickets.

How to evaluate “Digital K-1” claims (a buyer’s checklist)

If you’re comparing solutions, look for:

- True data-first K-1s (not “PDFs plus OCR”). Can you access field-level data and lineage?

- Bidirectional ecosystem: both creation and aggregation in one flow—no brittle bridges.

- Open integration surface: APIs, webhooks, and event logs, not just file drops.

- Controls & audit: permissions and immutable histories

- Time-to-value: weeks to first entity, not quarters.

Check out this How-To Guide: Evaluating AI K-1 Extraction Tools

No form to fill out!

For fund administrators, the upside compounds

- Capacity without headcount. Absorb more entities and complex allocations with the same team.

- Better client retention. Sponsors feel the difference when their LPs stop complaining about K-1 logistics.

- New services. Once K-1s are data, rollups, investor dashboards, and tax-ready exports become productizable.

Where to go from here

If your K-1 season still revolves around PDFs, portals, and hand-keyed numbers, you’re not just enduring pain—you’re accepting risk. A Digital K-1 ecosystem turns K-1s into first-class data that flows across your entire operation.

Ready to learn more?

Join one of our K1x Demo Days—a no-pressure, watch-only session where you can see the future of the Digital K-1 TM, from creation to investor delivery.

Prefer a deeper dive? Book a 1:1 walkthrough with our team to get your specific questions answered and benchmark your current cycle time against a fully digital flow.